[3.14(금)_2025 ] 앤트맨의 신나는 하루

[3.14(금)_2025 ] 앤트맨의 신나는 하루

[ 3월 ]

< 3주차 3.9 ~ 3.15, 2025 >

청명 2˚/16˚C

북북동풍 22˚ 2m/s

일출 6:44am ~ 6:37pm (11:53)

가시거리 22Km (매우 양호) 습도 58%

보름달_100% 기압 1,027hPa

4:30 ~ 10:30

92 / 2.7 / 114 - 3.12(수)

92 / 2.7 / 115 - 3.11(화)

93 / 2.7 / 115 - 3.10(월)

93 / 2.7 / 114 - 3.9(일)

94 / 2.6 / 111 - 3.2(일)

77 / 1.5 / 77.5 - 2.23(일)

73 / 1.9 / 101 - 2.16(일)

70 / 2.4 / 119 - 2.9(일)

71 / 3.3 / 161 - 2.2(일)

66 / 3.1 / 140 - 1.26(일)

51 / 2.7 / 110 - 1.19(일)

46 / 2.3 / 94.7 - 1.13(월)

No pains, no gains.

답은 이미 알고 있었다. 문제는 실천이다. 감사합니다.

Il Signore ha un disegno su di te.

"주님께는 너에 대한 큰 그림이 있으시다"

나에게 힘을 주시는 분 안에서 나는 모든 것을 할 수 있습니다. (필리피 4, 13)

I have the strength for everything through him who empowers me.

ㅇ 증시 일정

- 3.14(금) -

. 서울보증보험 신규 상장 (26,000원)

- 3.17(월) -

. 씨케이솔루션 신규 상장 (2차전지 드라이룸, 15,000원)

- 3.18(화) -

. 미국 2월 산업생산

o 금일 거래 종목 (2025.3.14. 금)

ㅇ 특징주 (2025.3.14. 금)

1) 서울보증보험

신규 상장 첫날 급등

2) 엠오티

2차전지 테마 상승, 삼성SDI ’46파이’ 배터리투자 소식, 탭웰딩 장비 독점 공급사 부각

3) 필에너지

삼성SDI, 시설자금(GM과 JV투자, 헝가리 공장, 전고체 배터리 라인투자) 등 확보 목적 2조원 유상증자 2차전치 테마

4) DSC인베스트먼트

퓨리오사AI, 메타로부터 경영권 인수를 위한 ‘최종 제안서’ 수령 재부각 속 관련주로 부각

5) CJ

CJ올리브영, 콜옵션 조기 행사 소식에 급등

6) 큐렉소

LG전자 등 글로벌 로봇 투자 확대 기대감 지속. 지능형 로봇/인공지능(AI) 테마 부각

7) 팬엔터테인먼트

드라마 ‘폭싹 속았수다’ 흥행 기대감 지속. 영화사 미디어캐슬 인수 소식 등에 급등

ㅇ 원/달러 환율 (2025.3.14. 금) 1,455.1 -1.9%

. 전고점 - 1,486원 (2024.12.27. 금)

. 전저점 - 1,303원 (2024.9.30. 월)

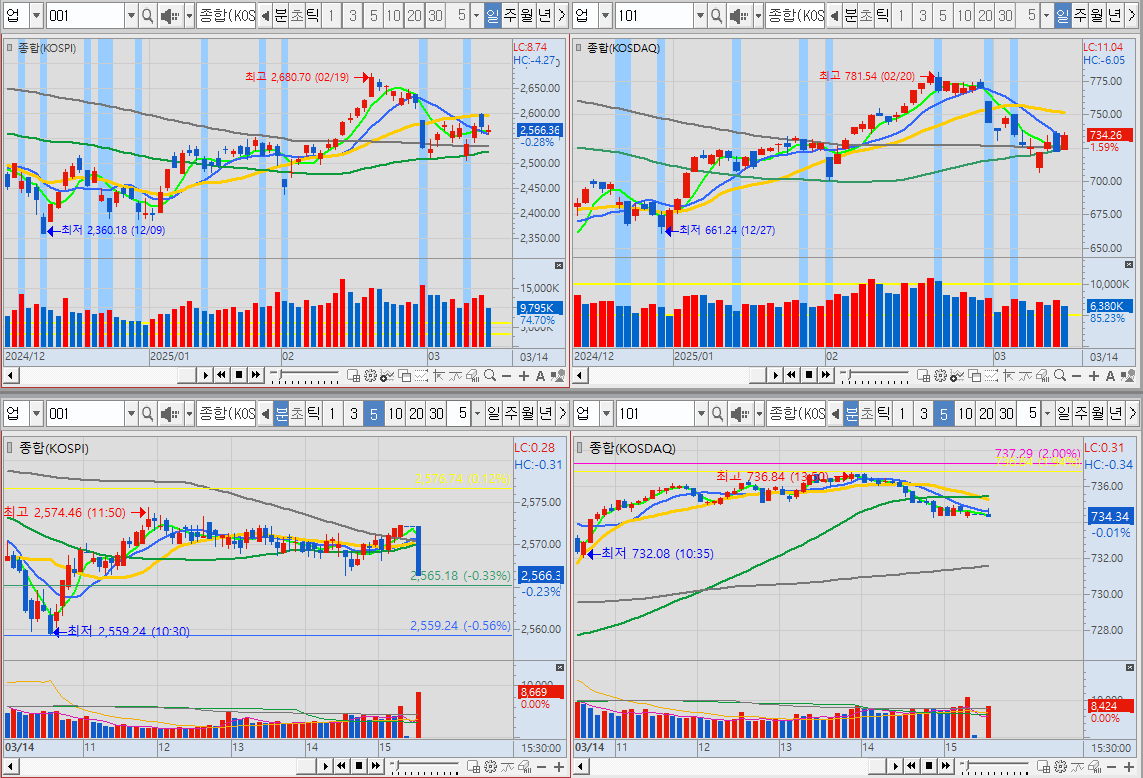

ㅇ 종합주가 지수 (2025.3.14. 금)

코스피 : 2,566.36 -0.28% 9.7조원 거래

코스닥 : 734.2 +1.59% 6.3조원 거래

ㅇ 투자자별 매매동향 - 일별 (코스피, 코스닥 2025.3.14. 금)

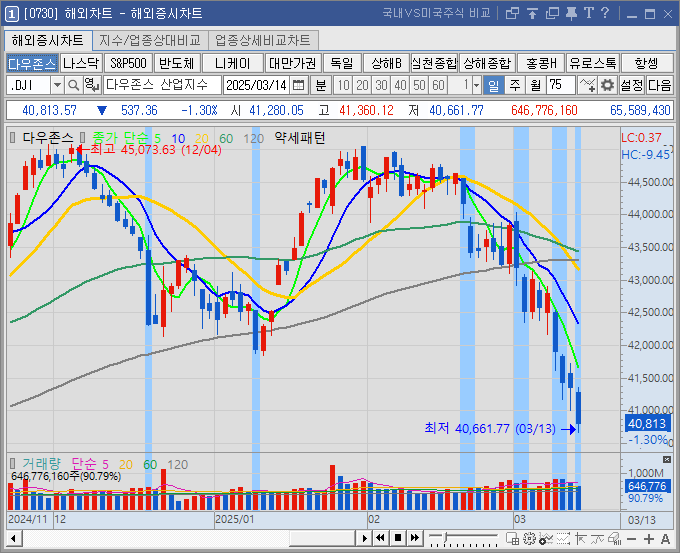

ㅇ 미국 주가 지수 (다우존스, 2025.3.13. 목) 40,813 -1.3% 바닥이 어디?

ㅇ 미국 주가 지수 (나스닥, 2025.3.13. 목) 17,303%, -1.96% 바닥 아니었나?

ㅇ 미국 주가 지수 (S&P500, 2025.3.13. 목) 5,521 -1.39% 바닥?!

ㅇ 반도체 지수 (필라델피아, 2025.3.13. ) 4,453.2 -0.62% 그래도 반도체는 버틴다?

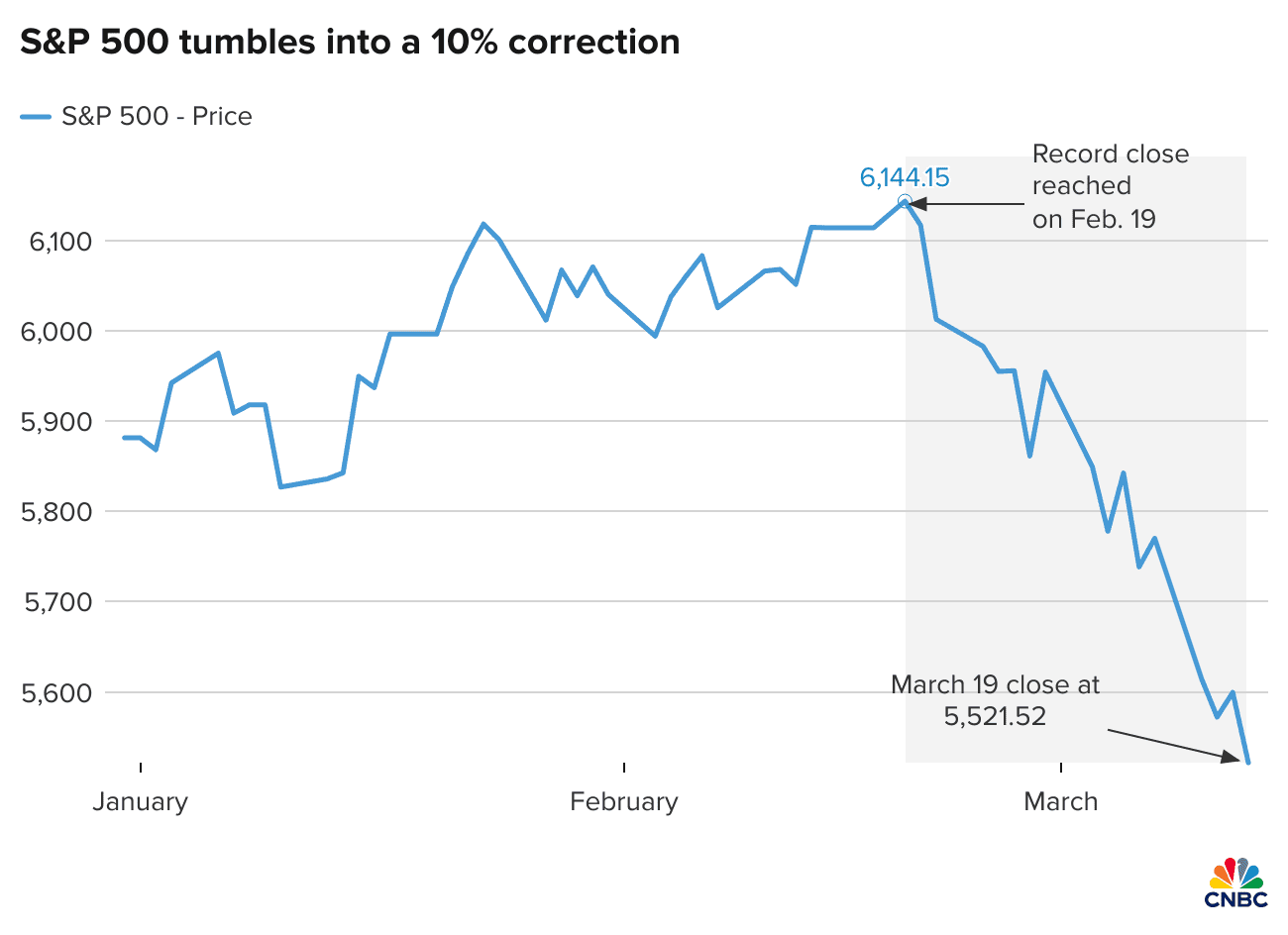

S&P 500 closes in correction territory Thursday as stocks tumble again on Trump tariff threats: Live updates

Stocks fell on Thursday, with equities unable to shake a three-week market rout under the weight of new tariff threats from President Donald Trump.

The S&P 500 dropped 1.39% to settle at 5,521.52. The index ended the day in correction, 10.1% off its record close. The Dow Jones Industrial Average fell 537.36 points, or 1.3%, marking its fourth day of declines and closing at 40,813.57. The Nasdaq Composite shed 1.96% with shares of Tesla and Apple lower.

Trump took to his Truth Social platform Thursday morning to threaten 200% tariffs on all alcoholic products coming from countries in the European Union in retaliation for the bloc’s 50% tariff on whisky. “This will be great for the Wine and Champagne businesses in the U.S.,” he wrote. Trump later remarked that he wouldn’t be changing his mind on a broader group of tariffs set to be implemented on April 2.

The disorderly rollout of Trump’s U.S. trade policy has rattled markets this month, with investors worried it was pressuring corporate and consumer confidence. The losses have intensified this week. The S&P 500 and Nasdaq are respectively on track for losses of 4.3% and 4.9% week to date. The Dow is off about 4.7% in the period, tracking for its worst week since June 2022.

The Nasdaq was already well into correction territory heading into Thursday’s session and now sits more than 14% below its recent record. The small-cap benchmark Russell 2000 is approaching a bear market, down roughly 19% from its high. On Wall Street, corrections are defined as losses of 10% and bear markets are drawdowns of 20%.

“These tariff wars are intensifying before they’re abating. It just adds to unpredictability and uncertainty, and that’s a negative for stocks, obviously,” said Jed Ellerbroek, portfolio manager at Argent Capital Management.

On Thursday, Treasury Secretary Scott Bessent said that the Trump administration is more focused on the long-term health of the economy and markets, rather than short-term movements. “I’m not concerned about a little bit of volatility over three weeks,” he said on CNBC’s “Squawk on the Street.”

Stocks fell despite some encouraging inflation signs. February’s producer price index — which measures the cost of producing consumer goods and is a good indicator of inflationary pressures — was flat that month, compared with an expected increase. This follows a softer-than-expected February consumer price index reading.

Though market strategists have been watching for a technical bounce after the recent sell-off, some say the latest inflation data likely isn’t enough to lead to a sizable rebound. Concerns over Trump’s trade policies remain a key hangover on investor sentiment, and they throw into question how the Federal Reserve may proceed on interest rates.

S&P 500 closes in correction territory Thursday as stocks tumble again on Trump tariff threats: Live updates

Investors digested the latest tariff threat from President Donald Trump, while they pored through new U.S. inflation figures.

www.cnbc.com