[3.4(화)_2025 ] 앤트맨의 신나는 하루

[3.4(화)_2025 ] 앤트맨의 신나는 하루

[ 3월 ]

< 2주차 3.2 ~ 3.8, 2025 >

흐림 -1˚/3˚C

동북동풍 68˚ 4m/s

일출 6:58am ~ 6:27pm (11:19)

가시거리 22Km (매우 양호) 습도 69%

초승달_20% 기압 1,023hPa

4:30 ~ 10:30

93 / 2.7 / 115 - 3.4(월)

93 / 2.6 / 115 - 3.3(월)

94 / 2.6 / 111 - 3.2(일)

77 / 1.5 / 77.5 - 2.23(일)

73 / 1.9 / 101 - 2.16(일)

70 / 2.4 / 119 - 2.9(일)

71 / 3.3 / 161 - 2.2(일)

66 / 3.1 / 140 - 1.26(일)

51 / 2.7 / 110 - 1.19(일)

46 / 2.3 / 94.7 - 1.13(월)

고수의 원칙을 계속해서 듣는다.

Il Signore ha un disegno su di te.

"주님께는 너에 대한 큰 그림이 있으시다"

나에게 힘을 주시는 분 안에서 나는 모든 것을 할 수 있습니다. (필리피 4, 13)

I have the strength for everything through him who empowers me.

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

ㅇ 증시 일정

- 3.4(화) -

. 트럼프 행정부, 청강.알루미늄 25% 관세 발효

. 국내 대체거래소 '넥스트레이드' 출범

. 스카이월드와이드 상호변경 (변경후 : SKAI)

< 실적발표 >

미국: 베스트바이 타깃

- 3.5(수) -

. 미국 2월 ADP취업자 변동

. 미국 2월 ISM 비제조업지수

. 임시국회 개회

. 인터배터리(InterBattery)개최

- 3.6(목) -

. 대진첨단소재 신규 상장 (2차전지 공정용 소재, 9,000원)

. 미국 1월 무역수지

< 실적발표 >

미국: 브로드컴

ㅇ 당일 매매 (2025.3.4. 화)

o 금일 거래 종목 (2025.3.4. 화)

ㅇ 특징주 (2025.3.4. 화)

1) HJ중공업

조선/LNG(액화천연가스) 및 방위산업/전쟁 및 테러 테마 상승 속 美 함정 MRO 사업 진출 목적 함정정비협약(MSRA) 체결 준비 소식 등에 상한가

2) 에코캡

지난해 호실적에 상한가

3) 대성하이텍

美-우크라이나 회담 파행 후 유럽 연합(EU), 우크라이나 추가 지원 및 군비 증강 논의 소식에 방위산업/전쟁 및 테러 테마 상승 속 상한가

4) 파인테크닉스

최대주주 변경 수반 주식양수도 계약 체결에 상한가

5) 한일단조

방위산업/전쟁 및 테러 테마 상승 속 155㎜ 포탄 수출 추진 소식 등에 상한가

6) 넥스틸

일부 철강 중소형 테마 상승 및 정부, 미국에 알래스카 가스 한미일 공동개발 관심 표명 소식 속 미국석유협회인증(API) 유정관(OCTG Pipe), 송유관(Line Pipe) 제조 사실 부각에 급등

7) RF시스템즈

美-우크라이나 회담 파행 후 유럽 연합(EU), 우크라이나 추가 지원 및 군비 증강 논의 소식에 방위산업/전쟁 및 테러 테마 상승 속 급등

8) 보로노이

임상결과 기대감 등에 급등

9) 한화에어로스페이스

美-우크라이나 회담 파행 후 유럽 연합(EU), 우크라이나 추가 지원 및 군비 증강 논의 소식에 방위산업/전쟁 및 테러 테마 상승 속 급등

10) 신송홀딩스

트럼프 대통령, 외국산 농산물 관세 부과 예정 소식 등에 음식료업종 테마 상승 속 급등

ㅇ 원/달러 환율 (2025.3.4. 월) 1,461.8 +1.12%

. 전고점 - 1,486원 (2024.12.27. 금)

. 전저점 - 1,303원 (2024.9.30. 월)

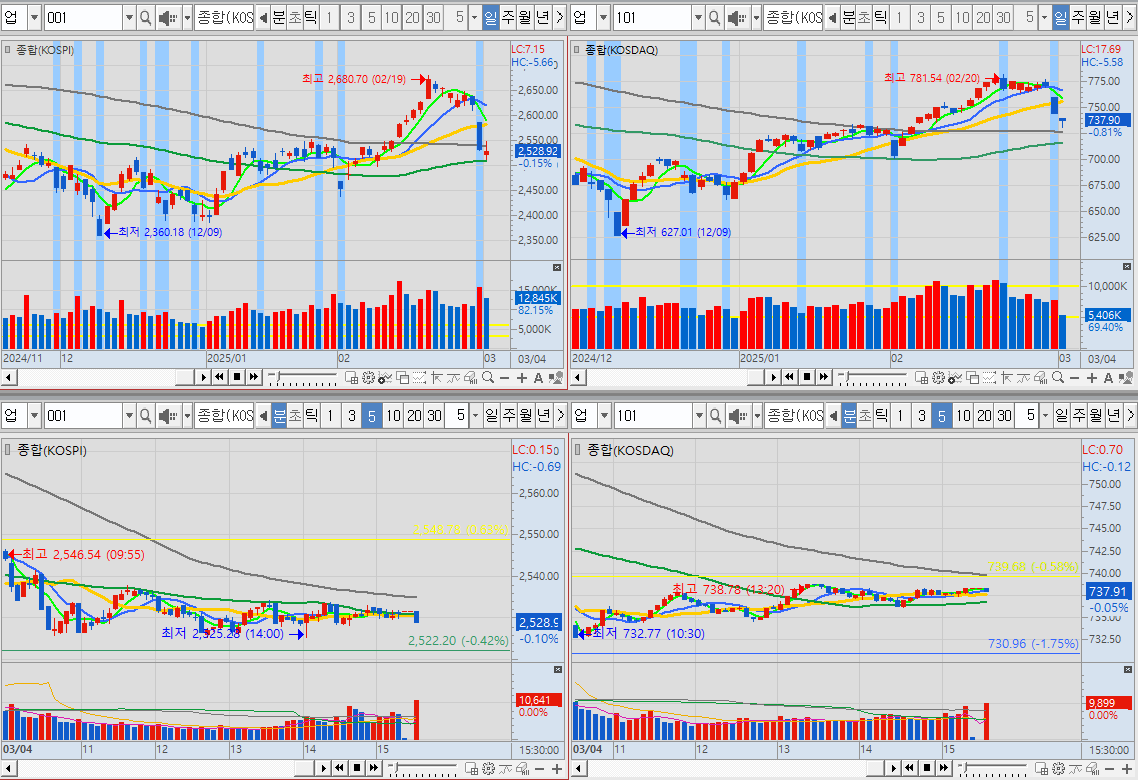

ㅇ 종합주가 지수 (코스피, 2025.3.4. 화) 2,528.92 -0.15% 12.8조원 거래

ㅇ 종합주가 지수 (코스닥, 2025.3.4. 화) 737.90 -0.81% 5.4조원 거래

ㅇ 투자자별 매매동향 - 일별 (코스피, 코스닥 2025.3.4. 화)

ㅇ 미국 주가 지수 (다우존스, 2025.3.3. 월) 43,191 -1.48% 서학개미들 매수 기회?

ㅇ 미국 주가 지수 (나스닥, 2025.3.3. 월) 18,350%, -2.64% 매수 기회?

ㅇ 미국 주가 지수 (S&P500, 2025.3.3. 월) 5,849 -1.76% 지지 확인하고 매수?!

ㅇ 반도체 지수 (필라델피아, 2025.3.3. 월) 4,575.8 -4.0% 살벌하게 빼네...

Dow tumbles more than 600 points, S&P 500 posts biggest loss since December as Trump says tariffs will proceed

The S&P 500 retreated on Monday, extending February’s rout and turning red for the year after President Donald Trump’s confirmation of forthcoming tariffs.

The broad index fell 1.76% to end at 5,849.72, marking its worst day since December and bringing its year-to-date performance to a loss of about 0.5%. The Dow Jones Industrial Average dropped 649.67 points, or 1.48%, to finish at 43,191.24. The Nasdaq Composite slid 2.64% to close at 18,350.19, weighed down by Nvidia’s decline of more than 8%.

Stocks took a notable leg down in afternoon trading following President Trump’s reiteration that 25% levies on imports from Mexico and Canada would go into effect on Tuesday, dashing investors’ hopes of a last-minute deal to avert the full tariffs on the two U.S. allies. All three indexes traded in positive territory earlier in the day, with the Dow rising nearly 200 points at session highs.

“No room left for Mexico or for Canada,” Trump said alongside Commerce Secretary Howard Lutnick from the White House. “Reciprocal tariffs start on April 2 … but very importantly, tomorrow, tariffs, 25% on Canada and 25% on Mexico … will start.”

Trump also signed an action to impose an additional 10% duty on China, according to an administration official.

A risk-off move ensued, hitting everything from technology to small caps. Beyond Nvidia, onetime popular artificial intelligence plays such as Broadcom and Super Micro Computer also plunged. Elsewhere, the small cap-focused Russell 2000 dropped close to 3%.

Stocks set to take a direct hit from the tariffs or retaliation by the targeted countries also fell. GM and Ford hit their lows of the session after Trump’s comments. Exchange-traded funds from iShares tracking Mexico and Canada each fell more than 1%.

“Whether the stock market can survive this change remains to be seen,” Chris Rupkey, chief economist at FWDBONDS, said in a note. “One way or another, tariffs will be a shock for the economy.”

Monday’s sell-off to start March comes after the three major indexes notched losses for February, largely over fear of the effect of tariffs and early signs of a weakening economy. The Dow and S&P 500 each slipped more than 1% in February, while the tech-heavy Nasdaq Composite recorded its worst month since April 2024 with a pullback of about 4%.

Soft economic data for the manufacturing and construction sectors released Monday offered the latest reasons for worry about the state of the U.S. economy. Those releases kick off a big week for economic data that will be capped by the February jobs report slated for Friday.

Dow tumbles more than 600 points, S&P 500 posts biggest loss since December as Trump says tariffs will proceed

Trump's plans to impose import duties on key U.S. trading partners this week loom over the stock market.

www.cnbc.com